SMALL FARMER ATLAS

COFFEE

The coffee sector faces a variety of complex issues – environmental, social and economic – that jeopardize the future of production. Coffee prices are highly volatile, which leads to unstable conditions for the 12.5 million small-scale farmers who produce the bulk of the world’s coffee. In addition to unstable markets, the persistent consequences of a changing climate – higher temperatures, disrupted weather patterns – have led to a projected 50 percent decrease in the land area suitable for coffee production by 2050. While price stability is high on the priority list, improving farmers’ ability to adapt to a changing climate is critical.

The Small Farmer Atlas explores the perceptions of small-scale farmers on a wide range of sustainability topics centered on three themes: prosperity, inclusivity and balance with nature. Small-scale coffee farmers from Indonesia, Kenya and Vietnam are included in this report.

SMALL FARMER ATLAS

PERCEPTIONS ON COFFEE

Although the coffee sector has the image of a sustainability frontrunner, it is failing to create the conditions needed for a flourishing value chain in the long-term. Forest conservation in combination with coffee agroforestry have the potential to reconcile economic and environmental goals, but require heavy investment and patience to realize long-term gains. Overall, farmers surveyed for the Small Farmer Atlas have a slightly positive view overall, though this is likely due to higher price levels when data was collected.

There is also a widening gap between highly efficient producing countries like Vietnam and Brazil, medium producing countries like Colombia and Indonesia, and nearly every other producing country. This disparity can be seen across the producer countries included in this report with Indonesia and Vietnam ranking higher in their overall score (+8 and+4, respectively) and Kenya more negative (-3).

Without investment in climate adaptation, many small-scale farmers lacking the resources, ability and flexibility to relocate, will have to abandon coffee production. (See also, the 2023 Coffee Barometer).

PROSPERITY

Most coffee farmers surveyed for this edition indicate that they are able to manage basic household needs. About 66% express satisfaction with the actual income derived from coffee.

INCLUSIVITY

In all three countries surveyed, the state plays a prominent role, yet only half of farmers were satisfied with access to finance and other services. This implies an opportunity for producer organizations to fill the gap and defend farmer interests.

NATURE

Views varied widely on production in balance with nature, from -22 in Kenya to + 10 in Vietnam. The low score in Kenya could be due to its susceptibility to changing climate conditions and inability to invest in adapting production practices.

SMALL FARMER ATLAS

SUPPLY CHAIN

It is estimated that the average green coffee export value accounts for less than 10% of the 200-250 billion dollars (US) of revenues generated in the coffee retail market. Revenues are highly concentrated in consuming countries, where the lion’s share of the value is captured by the top ten roasters, who combined receive 55 billion dollars (US) in revenue.

While downstream actors are successful in increasing their share of value of the finished product, the prices paid to producers are highly volatile and often not economically viable. In this reality, producers are under constant pressure to cut costs, especially those related to labor or the environment.

Between consolidation in the market place and concentration of production, small-scale coffee farmers in medium and small producing countries feel the greatest pressure.

SMALL FARMER ATLAS

3 QUESTIONS

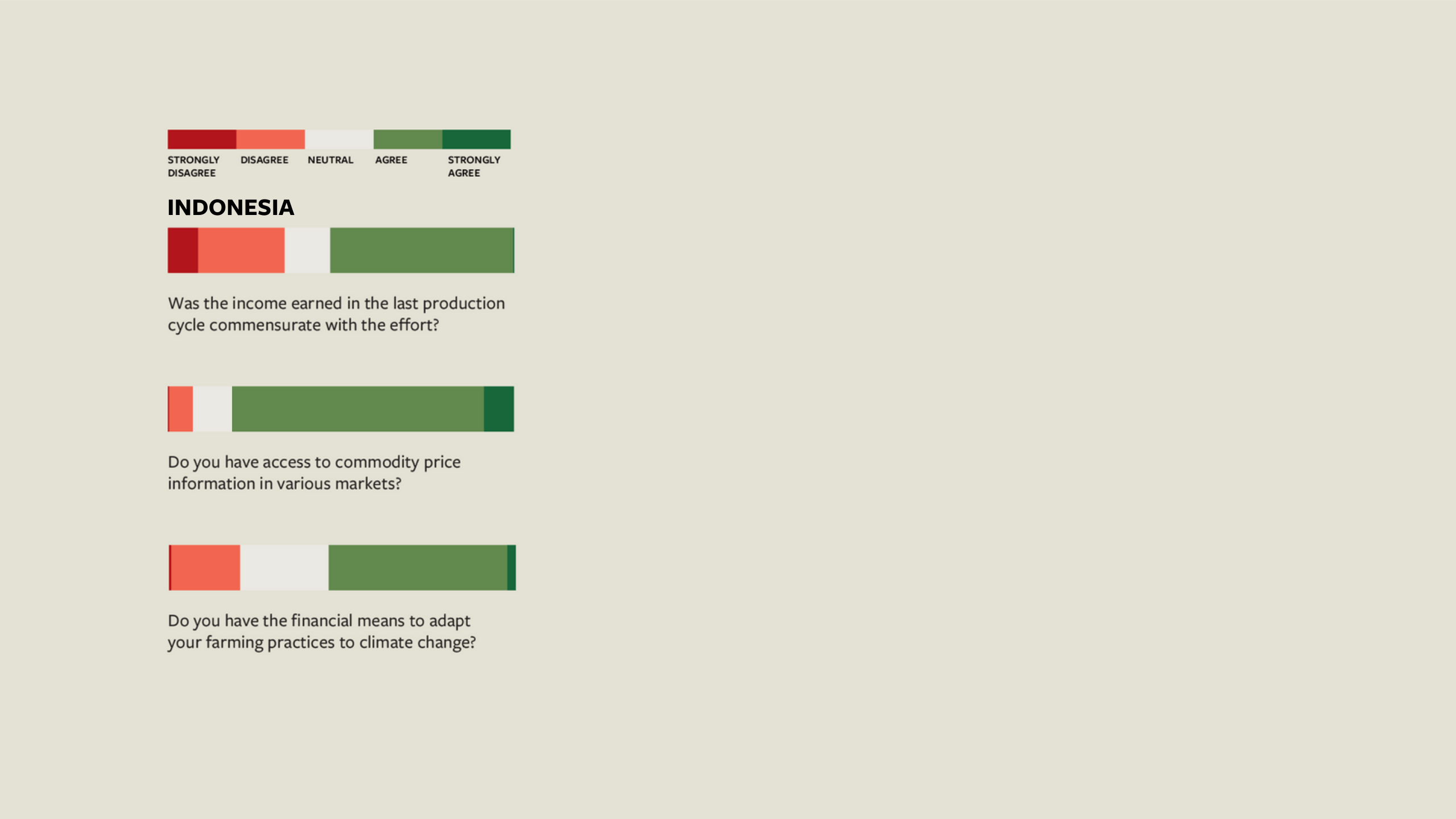

Indonesia is a highly efficient coffee producing country. On balance, they were more positive about current conditions than others. Climate change could have a large impact on land area suitable for coffee production with a projected decline of 25% by 2050.

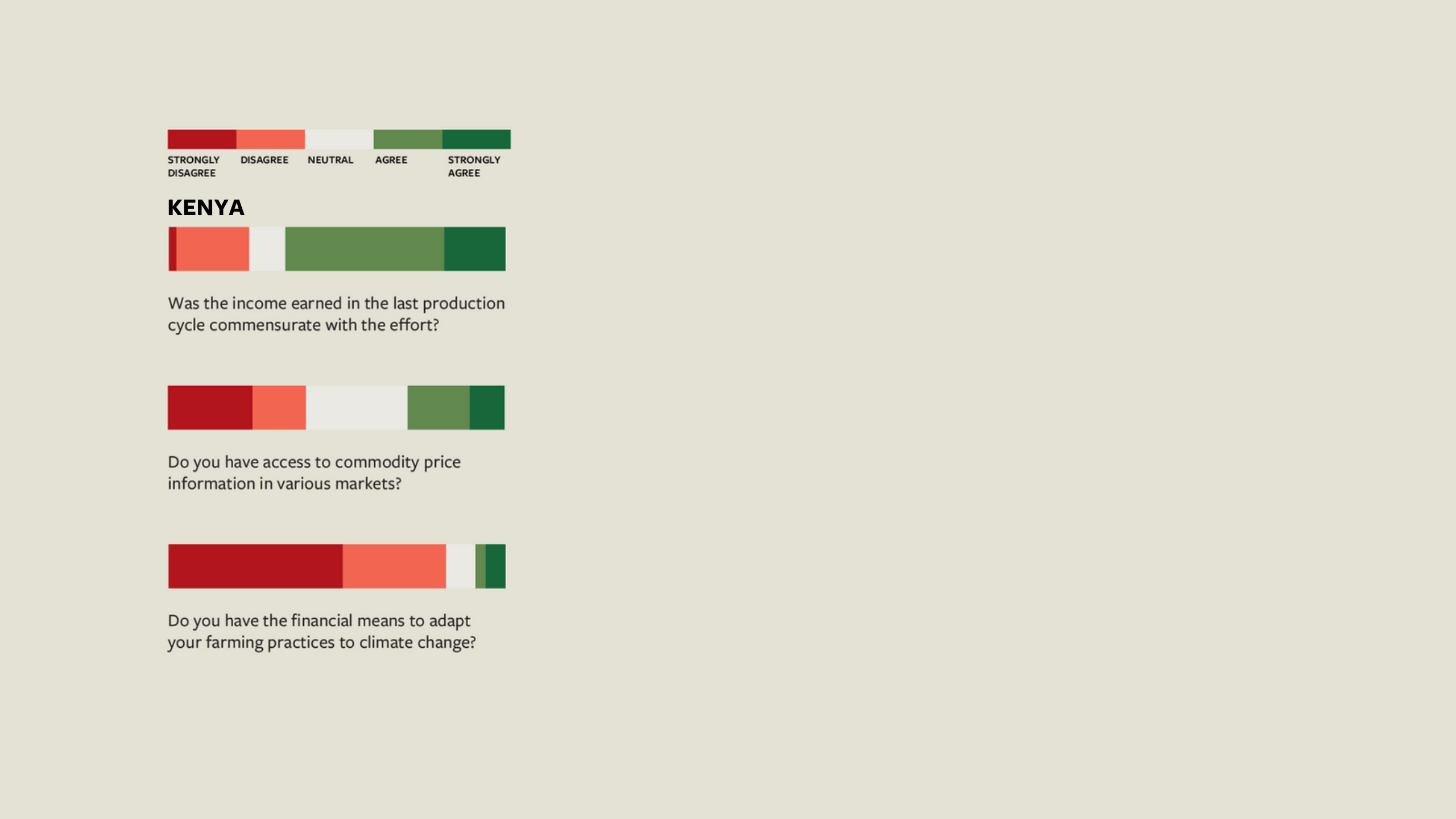

Kenyan coffee farmers indicated decent satisfaction with prices they receive, but many responded negatively to being prepared to adapt to climate change. This could be due to the fact that the Arabica coffee produced there is more susceptible to a changing climate, which could threaten their livelihoods.

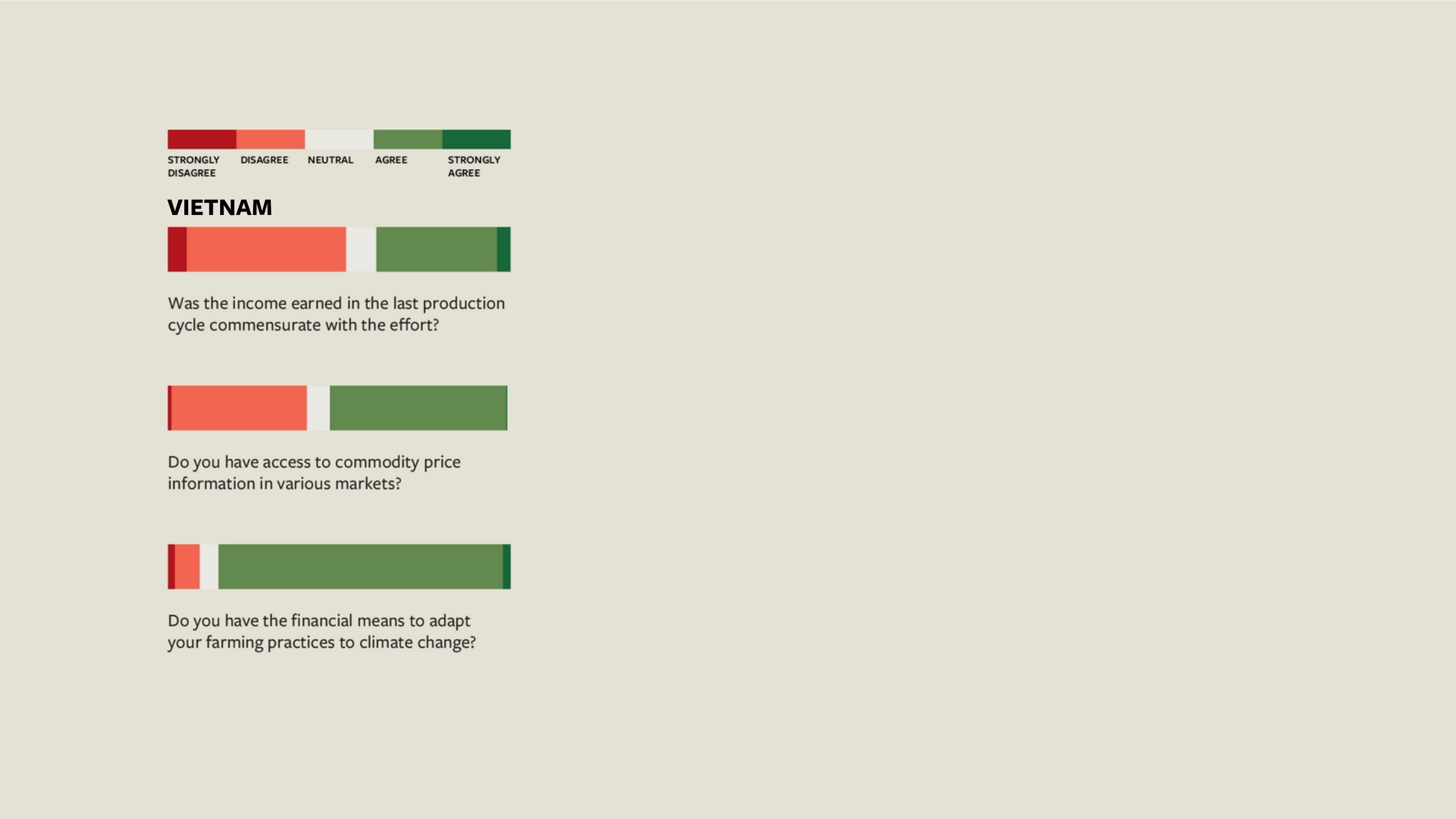

Coffee farmers surveyed in Vietnam indicated that they feel more prepared for climate change than others surveyed. This could be due to the fact that most farmers produce robusta, which is more tolerant of changing climate. Though market prices were high when the survey was conducted, farmers indicated dissatisfaction with their profitability, likely due to the increased production costs and global inflation.

MEET SMALL-SCALE FARMERS

A GRANDDAUGHTER'S WILL TO EFFECT CHANGE

By adopting organic practices and sharing her knowledge, Jemimah Nelima Chemiat helped her grandfather increase his yields and restore his land. Her guidance has inspired neighboring farmers and encouraged women and youth to take a more active role in the coffee value chain.

PARTNERSHIP DRIVES RURAL TRANSFORMATION IN COLOMBIA

Lucelys Vargas, a coffee farmer in Huila, is improving her farm’s efficiency and sustainability with new skills learned via a mix of digital platforms, hands-on workshops, and mobile learning programs.

Join the discussion

Looking for further insights and ideas or just want to share with others? Join the Small Farmer Atlas LinkedIn Group.

Download the PDF

The full Small Farmer Atlas goes into detail on that current state of sustainability from farmers' perspective.

Explore the data

This website represents a small portion of the data collected. Sign up to access the Data Portal and learn more.